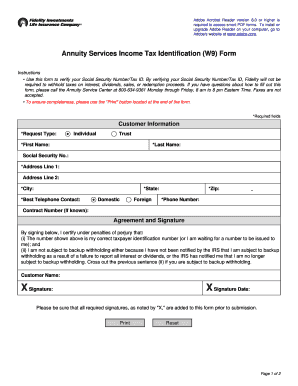

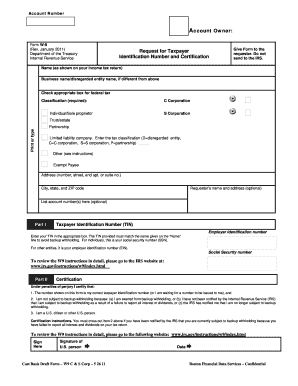

Let me know if you have any additional questions or if I can help in any other way. To make it easy for your vendors to submit the W9 electronically you can always invite a contractor to add their own tax info. While this doesn't specifically exclude photographs, you could probably make the case that they're not compliant. The electronic signature must be under penalties of perjury and the perjury statement must contain the language of the paper Form W-9. Require as the final entry in the submission an electronic signature by the payee whose name is on Form W-9 that authenticates and verifies the submission.Be able to supply a hard copy of the electronic Form W-9 if the Internal Revenue Service requests it.

I located this information on the W9 instruction sheet: The form must be signed, and the signing taxpayer is subject to civil. Hi for checking in with the Community for information about W9s.Īlthough this isn't my area of expertise, I was able to find some information on the IRS website that I think will be beneficial. The W-9 form provides key data clients need if youre an independent contractor.

0 kommentar(er)

0 kommentar(er)